As a homebuyer, it is critical to know the price of a property. A home can be an asset or a liability. The way you do the calculation determines the result. It is a famous saying in real estate; you don’t make money when you sell. You make money when you buy. The rule is applicable whether you are purchasing a commercial or a residential unit.

Most of us purchase a property with a housing loan. That means we’ll be paying for our homes for the next 10-30 years. That’s a long-term commitment, and we have to be cautious of our steps. Do you know the #1 reason for foreclosures is buying an expensive home. It is not written in statistics, but if you look closely, you’ll see the cause. People lose their homes because the house was unaffordable in the first place. That’s what history tells us. During the recession of 2008, people were taking out unaffordable loans. They were purchasing properties with skyrocketing prices. In this article, we’ll discuss the same scenario, and how the prices tend to go up and down, and what you should do about it.

Regression to Mean:

It’s a rule in the stock exchange. Every investor knows that eventually, the stock price will revert to its long-term average. When the prices go up, they will come down. After a specific increase in prices, the investor starts selling their stocks, because they know, the costs will drop soon. Take the example of bitcoin. It went all the way up to $20,000, and then down to $3,000. Now bitcoin is a relatively new currency. We cannot yet predict its long-term average. However, we can do that for the real estate industry.

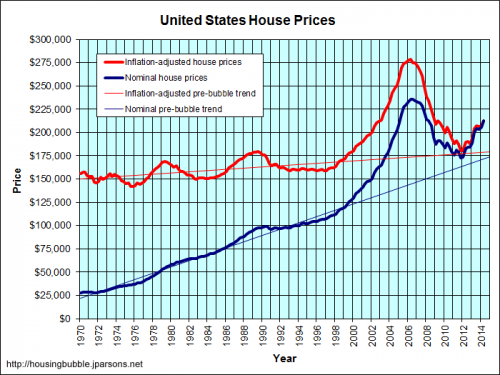

Reversion to means principle states that prices will go back to their long-term average. We have to consider the inflation rate. If you look closely, home prices have always stayed near the $150k mark in most areas of the US. This price has been adjusted for inflation. That means home prices have stayed the same, give or take a few dollars. You could say the prices were up in the 1990s, and that was the best decade for the industry or that prices were down in 2010s, and that was the worst part. However, if you look at the past 50 years, you’ll realize, prices have remained the same.

Market Psychology Drives the Costs

Cost, supply, interest rate, politics, and lending terms are all indicators. They are the effect and not the cause. It is not the interest rate or the political situation that is driving the real estate market. These situations can affect an area temporarily, but they cannot shift the pricing structure.

It’s often the market psychology that drives the price. Look closely, and you’ll find only two emotions: greed and fear. When one is absent, the other takes over.

When prices go down, people fear a recession. That’s when we see a profound decrease in values. When we see an upward trend, greed provides fuel. People raise prices, and people buy more. We are in trouble, and prices go down.

As a buyer, what should be your action plan? When should you buy a house?

Between the up and down, there lies the average. A balanced market where prices are close to the long-term average, and you hear both about the boom & bust of the industry. That’s when you should buy a house. You can compare the prices to their long-term average, and see if it makes sense to purchase the home.

Another rule of thumb is never to buy an unaffordable house, no matter how good the deal is. If your finances are right, then a recession cannot do anything to you. However, if you are in financial trouble, a great market cannot help you.

Feel free to contact us to discuss more on this subject.